Architecture overview of the system, it’s capabilities, and learnings of how they got there.

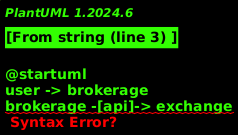

Most users shouldn’t use an exchange directly. They should speak w/ a brokerage.

2 big components: oms (order management system): user balances, risk checks, margin decisions matching engine: “order books” aka balancing the buy/sell ledger, also generates market data

hot path: balance check, order matching warm path: settlement auxiliary: market data feed

They have different trading system processes, depending on (for instance) the market [eth, usd].

After the trading system finishes it’s work, the market segmentation is merged into a single event stream.

—

Trading system logic isn’t complex.

- match incoming orders against resting orders (‘book’)

They try to model it as a deterministic state machine. Problems:

- datastructures: iteration may be different, depend on how big the underlying datastructures are.

- old input = old behavior. Meaning they need to use feature flags encoded into the state.

They use RAFT to help w/ fault tolernace.

- They use Aeron Cluster.

- Aeron Archive allows them to serialize the raftlog (requirement of protocol)

They use the resulting raft log for:

- debugging.

- traffic replay for CI/CD

---- they’re basically going too fast to take notes. :-/